CUSTOMERS ❯ SPEAR STREET CAPITAL

Established in 2001, Spear Street Capital is an owner and operator of distinct office properties in the United States, Canada, and Europe.

Spear Street exemplifies a strong foundation and cross-functional responsibilities in asset management. When they sought a solution to improve portfolio management and transactions, they partnered with Prophia in 2019.

PROPHIA RESULTS SUMMARY: INCREASE EFFICIENCY AND RISK MANAGEMENT

-

Critical Dates Notifications allow asset managers to stay on top of encumbrances in order to maximize landlord optionality

-

Lease Summaries provide quick tenant data for leasing conversations

-

Portfolio Reports pull lease and building details across multiple assets for easier cross-portfolio analysis

CHALLENGE: STATIC SYSTEM OF MANAGING LEASE DATA AND ENSURING ACCURACY

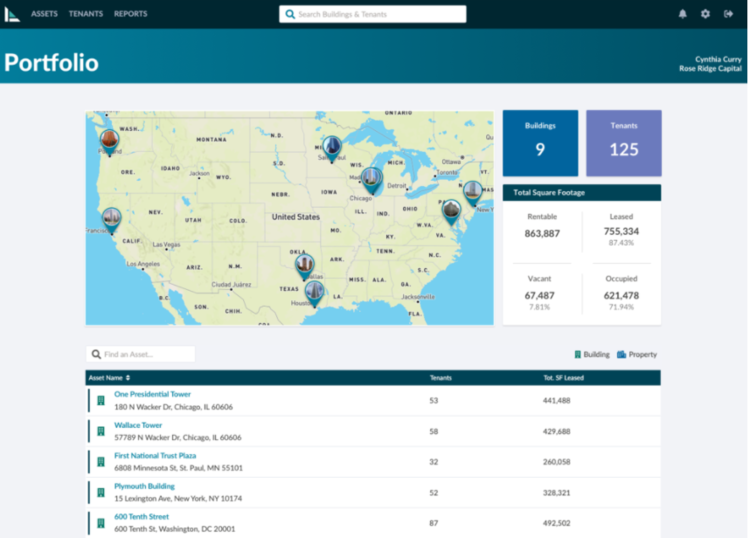

Portfolio Dashboard (sample data)

Before adopting Prophia, Spear Street used various static practices to keep track of encumbrances and relied on property managers to send monthly reports. In addition to data found in accounting systems, asset managers updated large internal spreadsheets for rights and options monthly. There was no way to measure accuracy beyond trusting the humans who inputted the data themselves. As a result, asset managers ended up having to both update and verify the accuracy of the data.

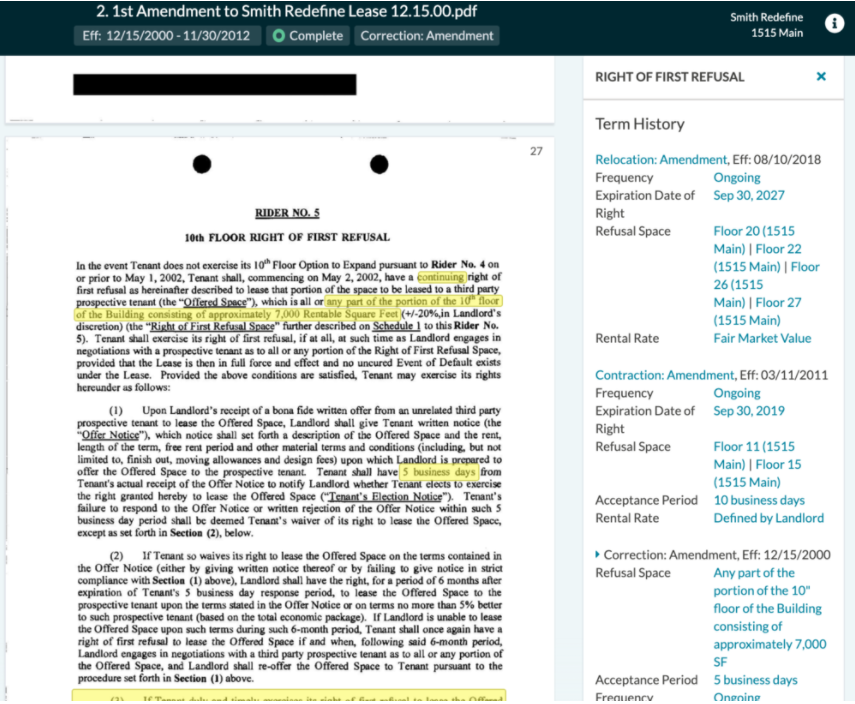

Term History of a ROFR (sample data)

Over time, asset managers were overrun with manually managing lease data.

“With a static system to manage leases, there’s always a trust issue. You don’t know if things are updated or changed. Maybe one day you trust your abstracts but later on, you start to doubt,”

Portfolio Manager

This process made it more difficult to think entrepreneurially in the day-to-day, and there was the risk of falling behind on critical dates. As asset managers increased their responsibilities within the firm, the complexity of managing all of the data increased the vulnerability to error.

Spear Street wanted to avoid the silos stagnant data created and saw the benefits of tethering all reporting to their source documents as an evolution of their current practices. As the firm grew, the need for a centralized data management solution for their portfolio drew them to Prophia.

SOLUTION: PROPHIA’S COMPREHENSIVE, CENTRALIZED LEASE DATA MANAGEMENT ACROSS EVERY ASSET

Prophia Cloud’s centralized lease data management solution means everyone at Spear Street has access to tenant and portfolio data across every asset. Their team utilizes features that highlight the term history across the life of the lease at the document level, making it easy to analyze a tenant’s rights and options quickly. This feature, exclusive to Prophia, eliminates flipping or scrolling through multiple documents to see the evolution of a right or option.

With data now at their fingertips, Spear Street’s team is able to more quickly make decisions both in tenant optionality and when it comes time for asset transactions.

Critical dates notifications pull directly from the lease so Spear Street no longer has to rely on monthly updates to mass spreadsheets. This automation alleviates the risk associated with missing a critical date and allows for planning ahead of time in order for landlords to be more strategic when looking to leverage landlord optionality.

“At its foundation, Prophia brings value with efficiency and risk management within your portfolio. The secondary layer is what you do with that data to define and differentiate yourself as an organization. ”

Spear Street Capital

Companies like Spear Street see the value of trusting their entire portfolio to Prophia Cloud. Spear Street’s processes no longer include stagnant data and instead trust a centralized platform with reports that tether tenant data directly to the lease. This allows all levels of management to think entrepreneurially and strategize to increase landlord optionality now more than ever.

ABOUT PROPHIA

Commercial Real Estate (CRE) professionals who use Prophia Cloud access critical lease information from anywhere in the world in a centralized, cloud-based platform. Prophia extracts meaningful lease data and dynamically tethers it to source documents, making custom reporting, modeling, exporting, and data reconciliation more advantageous for all CRE executives and acquisitions teams.